PLANNING

Charitable Remainder Trusts

OUR OFFICE

ARTAAD Financial

128 Tommy Stalnaker Drive

Suite 300

Warner Robins, GA 31088

PHONE 478-333-3790

FAX 478-333-5043

What is a charitable remainder trust?

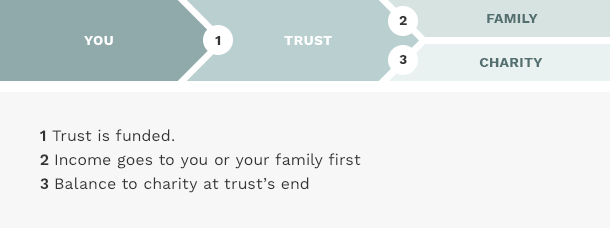

A charitable remainder trust (CRT) is an irrevocable trust used to enable donors (called grantors) to give money or property to charities, while continuing to receive income (fixed or variable) from the property for life or for a period of time up to 20 years. The grantor, and/or other beneficiaries (the income beneficiaries) receive distributions from the trust annually, and the charities (the remainder beneficiaries) receive the assets remaining in the trust when the trust ends. The grantor gets an immediate income tax deduction for the remainder interest (subject to the usual limitations), defers or avoids capital gains tax on the donated assets, and gets gift or estate tax deductions for the remainder interest.

How does a charitable remainder trust work?

There are three variations of the standard CRUT, which makes payouts even if principal must be invaded:

A CRT can be funded with most types of assets, but since minimum distributions to income beneficiaries are required, it may be preferable to use cash and marketable securities, or to structure the trust as a NI-CRUT, NIMCRUT, or Flip CRUT (see above) to buy time to sell unmarketable assets.

The IRS may require a qualified appraisal for unmarketable assets (e.g., a closely held business or real property).

The present value of the remainder interest to charity must be at least 10% of the fair market value of the trust property as of the date the property is contributed to the trust. For CRUTs, this requirement must be satisfied upon the initial and any subsequent contributions.

Trust is tax-exempt

Generally, both CRATs and CRUTs are wholly tax exempt, even though they are only partially charitable, as long as the trust complies with IRS rules. So, say a grantor transfers highly appreciated non-income-producing property to the trust. The trustee can sell the property and invest the proceeds, un-depleted by capital gains tax, in an investment portfolio that may yield a higher return than the donated property.

A CRT that has unrelated business taxable income (UBTI) will not lose its tax-exempt status, but may face an excise tax equal to 100% of the UBTI.

Generally, distributions from a CRT are taxable to the recipient under a tiered system. If the trust payout is from earned income (e.g., interest dividends, rents), the payout is classified as ordinary income. If the trust payout is from principal, the income is classified as a distribution of long-term capital gain first, then tax-exempt income (e.g., municipal bond interest), then return of principal (tax free, of course).

Generally, contributions to qualified charities are tax deductible for taxpayers who itemize. The amount of the tax deduction for a transfer to a CRT is usually the present fair market value of the remainder interest to charity (see above), subject to certain IRS limitations (50% of adjusted gross income for gifts of cash, 30% of adjusted gross income for gifts of appreciated stock or real estate) per year. Deductions are available for the tax years in which contributions are made, and any unused portions can be carried over to the next five tax years.

If contributions are tangible personal property (e.g., works of art, rare books or coins) or would result in short-term gain if sold, deductions may be limited to the property's cost basis, not fair market value.

Gift and estate taxes will apply on payouts to income beneficiaries who are not grantors or their spouses.

Grantor is an 80-year-old widow with no heirs who owns property with a net fair market value of $1 million, most of which is real estate with a cost basis of $250,000. Grantor is in relatively good health, and is planning to move to an assisted living facility. If grantor sold her property, income tax would be due on the gain at a 15% or 20% tax rate.

Instead, grantor creates CRAT, naming her husband's alma mater as charitable beneficiary, as follows:

- Grantors are a married couple, both aged 55, with high-paying jobs who are concerned about conservation.

- Grantors own marketable securities that cost them $50,000 which are currently worth $200,000. They would like to reduce their income taxes and make a gift to a charitable conservation organization. If they sold the securities, income tax would be due on the gain at a 15% or 20% tax rate.